Overview of Portland Oregon Industrial Marketplace 2024

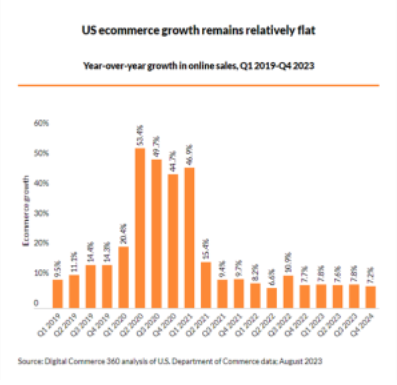

Weak tenant demand has increased industrial vacancies throughout the Portland Metro marketplace. As the Covid driven purchasing cycle has passed, demand for e-commerce sales has flattened. This reduction in demand, coupled with increased interest rates and inflationary challenges, have dampened market demand enough to create a level of uncertainty that has reduced the demand for industrial space in the Portland Metro Marketplace. A part of this reduced demand for industrial space is related to a slowdown in consumer spending and the reduced job growth in the Portland metro area (-1.5%). (As published in April, by Jake Procino at the Employment Department of the State of Oregon, Multnomah County Economic Indicators).

Slowdown

Hazel King at Parcel and Post Technology International opined in a Feb 14, 2024 article: “The latest Online Retail Index from IMRG has revealed e-commerce sales have been slow to get going in 2024, with revenue falling 7% year-on-year (YoY) in January against a decline of 3.5% last year. From the high growth rates seen during the pandemic, e-commerce revenue decreased by 10% YoY in 2022 and 3% YoY in 2023, with IMRG forecasting 0% YoY growth in 2024.”

There is continued demand for online goods, just not at the pace that existed during the Covid timeframe. (1)

This is also reflected in a slow down early 2024 in the greater demand for consumer goods/consumer demand. “The consumer buckled at the start of the new year. January retail sales fell 0.8%, a much steeper fall than the -0.2% consensus estimate. January’s drop was the biggest decline in nearly a year, since March 2023’s -0.9%. December retail sales were revised lower to +0.4% from the +0.6% originally reported. Other areas of weakness in the January report included health and personal care store sales, -1.1%, clothing and sporting goods stores, each down 0.2%, and general merchandise stores that were flat.” (2)

Shopping Statistics (3)

Here are some helpful datapoints about online and in-store shopping that help shape the discussion regarding the demand for more growth of distribution (and retail) space and the need for same day delivery warehousing:

• Return rates: 31% of online orders are returned, compared to 8.89% of in-store purchases.

• Product viewing: 75% of consumers want to see a product in store before buying it online.

• Consumable goods: 78% of consumers prefer to buy consumable goods in-store.

• Technology products: 64% of consumers buy technology products in-store.

• Final purchases: 81% of shoppers expect to make their final purchase in a physical store after finding a product online.

Rent Growth

Year-over-year rent growth is also suffering from the lack of demand, as it has slowed to 3.2% as of the second quarter. It is expected that as forecasted tenant demand wavers, rents will either slip or plateau due to the increased vacancy rates. Though due to the significant “urban growth boundary” development challenges, the growth of new construction is limited in the metro which may level the rents in 2024 as demand for space dampens, and available sublease space increases.

One additional driver for marketplace change is that some tenants are deciding to move to the Washington’s west side of the Columbia River, Vancouver, Battleground, Camas for example, to seek tax relief from the onerous income taxes in Multnomah County.

Does Size Matter?

In the past 12 months four leases exceeding 200,000 sq ft have been signed, while in the 2021 period there were ten such deals, a few exceeding 400,000 sq ft.

When reviewing statistics, there were fewer large transactions in the marketplace over the last few years than transactions in the 5000 to 100,000 sq ft range. This stands to reason given that there are more smaller companies than larger companies in general.

Impact of Closing Terminal Six (6) to Containerized Traffic

One additional challenge for the Portland metro Industrial market is the planned closing of containerized shipping at Terminal 6 in October of 2024. The closure is expected to have widespread repercussions, affecting hundreds of jobs and businesses across Oregon, Washington, and Idaho, which will need to reroute their shipping through other West Coast ports, such as Tacoma and Seattle.

This shift will likely lead to increased costs for businesses, with additional expenses estimated at $150 to $300 per container for transportation. This will also affect nearly 1,500 jobs across the state. The container operation creates 696 direct jobs and an estimated 871 indirect jobs in the region, according to the port.

It connects Oregon businesses with an international market, moving about $782 million worth of products a year, according to a 2021 study by BST Associates. Undoubtedly this will also mean a reduction in demand for Portland Metro area industrial space. (4)

Late Breaking news – on the 5/16/2024 Oregon Governor Kotek announced that she was going to include two critical items in her 25-27 Biennial Budget. First, there will be a continued commitment by the State to help the Corps of Engineers pay for dredging and channel maintenance in the Columbia. Second, the State will also support operational stop gap funding in order to balance the operational budget and help pay for capital improvements at terminal 6. As a result of this news the Port of Portland has decided to keep Terminal 6 open.

Summary

In short, the Portland Metro area demand for industrial space has been dropping for the last year and is expected to continue its slow down for 2024. We can blame this on many things.

1. The drop in Oregon’s population by 14%; (5)

2. The lack of jobs being generated;

3. Interest rate uncertainty, and high interest rates slowing growth-oriented decisions;

4. High income taxation in Multnomah County;

5. The lack of economic growth.

Time will tell how the marketplace will respond in 2025 when many leases are up for renewal. In the meantime, as vacancies slowly increase, tenants have the edge when negotiating with the landlords.

Acknowledgments/Sources

The author wished to acknowledge the assistance of John Gillam, Costar Director of Market Analytics, Portland, Jim Wierson and Olesya Prokhorova in the writing of this article.

(1) https://www.parcelandpostaltechnologyinternational.com/news/ e-commerce/e-commerce-gets-off-to-a-slow-start-in-2024.html

(2) https://kpmg.com/us/en/articles/2024/january-2024-retail-sales. html#:~:text=The%20consumer%20buckled%20at%20the,the%20 %2B0.6%25%20originally%20reported

(3) https://www.google.com/search?sca_esv=3cb57a3b0b929ed3&rlz= 1C1CHBF_enUS974US974&sxsrf=ACQVn0-DTjipCc28c9z0wRBJJuig9Ox zRQ:1714490410908&q=statistics+re+delivery+of+goods+vs+shopping +in+stores&spell=1&sa=X&ved=2ahUKEwjewKa_nuqFAxVylYkEHTFz CCQQBSgAegQIEBAC&biw=1280&bih=639&dpr=2

(4) https://nwlaborpress.org/2024/05/port-of-portland-to-close-its container-terminal/

(5) https://www.kgw.com/article/news/local/oregon-residents-most moved-states

Clifford A. Hockley, CPM, CCIM, MBA

Cliff is a Certified Property Manager® (CPM) and a Certified Commercial Investment Member (CCIM). Cliff joined Bluestone and Hockley Real Estate Services 1986 and successfully merged that company with Criteria Properties in 2021.

He has extensive experience representing property owners in the sale and purchase of warehouse, office, and retail properties, as well as mobile home parks and residential properties. Cliff’s clients include financial institutions, government agencies, private investors and nonprofit organizations. He is a Senior Advisor for SVN| Bluestone.

Cliff holds an MBA from Willamette University and a BS in Political Science from Claremont McKenna College. He is a frequent contributor to industry newsletters and served as adjunct professor at Portland State University, where he taught real estate related topics. Cliff is the author of two books 21 Fables and Successful Real Estate Investing; Invest Wisely Avoid Costly Mistakes and Make Money, books that helps investors navigate the rough shoals of real estate ownership. He recently formed a real estate consulting practice, Cliff Hockley Consulting, LLC. to help investors successfully navigate their investments. He can be reached at 503-267-1909 or cliffhockley@outlook.com.